Millennial retail trends: online retail in the Amazon Era

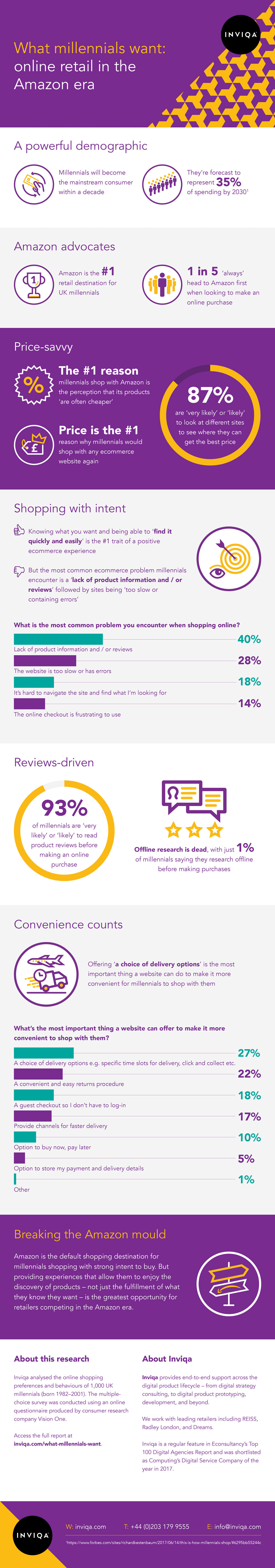

Forecast to represent 35% of spending by 2030, millennials will become the mainstream consumer within a decade. To help online retailers better cater to this crucial demographic, we analysed the online shopping behaviours of 1,000 UK millennials. Here’s what we learnt.

Millennial ecommerce trends: what you need to know

Together with consumer research company Vision One, we surveyed a nationally-representative sample of 1,000 UK millennials to help retailers understand how they can adapt ecommerce experiences to better meet the needs of millennial shoppers.

Our report – based on a multiple-choice survey conducted using an online questionnaire – analyses the online shopping preferences and behaviours of UK millennials (defined as UK citizens born 1982–2001).

Here are the headline findings of the report:

- Amazon is the number-one retail destination for millennials. 1 in 5 millennials ‘always’ head to Amazon first when looking to make an online purchase; 59% ‘always’ or ‘often’ start their online shopping journeys on Amazon.

- Price is king for UK millennials. Price is the resounding number-one consideration for millennials when it comes to online retail. The leading reason millennials choose Amazon over other ecommerce sites is the perception that its products are often cheaper. Price is also the primary reason why millennials would shop with any ecommerce website again. A massive 87% of price-savvy millennials are very likely (41%) or likely (46%) to look at several different websites or apps to see where they can get the best price for a product.

- 16-36-year-olds shop with intent. Asked what makes a positive ecommerce experience, millennials say, above everything else, millennials say that their best online shopping encounters are when they know what they want and can find it quickly and easily. But ecommerce websites are making this difficult by failing at the basics, from site performance to product information. The most common problem millennials encounter when shopping online is a ‘lack of product information and / or reviews’ followed by the site being ‘too slow or containing errors’.

- Amazon is transactional, not inspirational. Almost 1 in 10 millennials say the reason they would choose not to shop with Amazon is because they don’t always know what they’re looking for and it’s hard to find inspiration on Amazon. Amazon is the default shopping destination for millennials shopping with strong intent to buy, but providing experiences that allow consumers to enjoy the discovery of products, not just the fulfillment of what they know they want, is the greatest opportunity for retailers battling Amazon for millennial customers.

- Reviews are integral to the ecommerce journey. A massive 93% of millennials are very likely (56%) or likely (37%) to read product reviews before making an online purchase. Offline research is dead, with just 1% of millennials saying they research offline before making online purchases. Mobile is king for research, and desktop / laptop is king for purchases.

In Amazon’s quest to be the low-cost provider of everything on the planet, the website has morphed into the world’s largest flea market – a chaotic, somewhat lawless, bazaar with unlimited inventory’.

Ari Levy, CNBC

What millennials want: key observations

Our research shows that millennials care about price, convenience, and a retailer’s ability to cater to their individual perceptions of value. They frequently shop with a clear idea of what they want and a drive to purchase, and they expect detailed and accurate product information, balanced reviews, and third-party endorsements, along with a frictionless path to purchase.

But they also shop for inspiration and enjoy the discovery of new products, often aided by the likes of social media channels and peer recommendations. Amazon has developed a compelling transactional platform that caters to those shopping with intent, but it doesn’t offer every retail experience a millennial is looking for.

Herein lies the opportunity for retailers to surprise, delight, and inspire, and to make online retail as much about the enjoyment of product discovery as it is about fast fulfillment.

Millennial retail trends: the full story

Download the full report to explore our survey findings in full:

- Get the complete survey results

- Learn how to better cater to the needs of millennial shoppers

- Discover how to exploit Amazon’s weaknesses and engage this critical demographic